Achieving a circular economy in Europe: Introducing the plastics industry ‘wish list’

Leading plastics recyclers, including MBA Polymers, joined with major waste management associations in November to announce a shared ‘wish list’ of steps required from EU policy-makers to catalyse greater recycling of waste cars and electronics.

“We’ll see an increasing level of discussion and debate about the shape of the EU’s Circular Economy Package over the next two years,” says Richard McCombs, MBA’s CEO. We’re making a plea to leaders, innovators and key influencers involved in the debate by sharing some clear recommendations that could help to drive change and promote the circular economy.”

The current state of play

The production of new vehicles is steadily rising. There are currently an estimated 275m vehicles registered in the EU, representing an impressive ‘urban mine’ of materials. Plastic (or elastomer material) – made primarily from non-renewable oil-based resources – comprises some 20 to 25% of the average vehicle. Meanwhile, of the 9.5m tonnes of waste electrical and electronic equipment (WEEE) generated in Europe each year (including 1.2m plastics), only five to six tonnes are recycled. The technology exists to recycle 50% of the plastics derived from waste electronics, while the rest could be used for energy recovery.

Current ELV and WEEE targets in Europe:

- ELV: 95% of an ELV should be recovered with 85% of materials recovered

- WEEE: 80% of consumer electronics should be recovered (with 70% of materials recovered) and 85% large domestic appliances should be recovered (with 80% of materials recovered). These rates change over time.

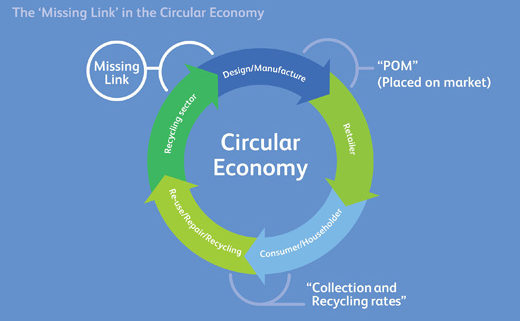

One of the key barriers to up-scaling the volumes of plastic currently recycled is that vehicle and electronics manufactures in Europe currently hold the responsibility for capturing post-consumer waste and attempting to recycle or recover their products. In the main, manufacturers are responding to this by introducing take-back systems. However, this does not go far enough to catalyse a circular economy model whereby products would be designed for reuse, recovery or recycling, and waste materials would be systematically re-captured and channelled into new products.

What’s needed to make the circular economy a reality is for everyone involved in the product development and manufacturing process – product designers, materials purchasers, marketing managers and production engineers – to consider end-of-life product responsibility right from the outset. There is currently no clear link between the ‘take-back’, collection and recycling of waste materials and the design, procurement and sales of new products.

In particular, it’s vital for companies to consider the chemical and physical make-up of their products at the design stage – how could each material be recovered, reused or recycled? In the plastics recycling industry, one of the challenges we face in recycling post-consumer plastics is that there are strict rules – with ever-changing thresholds – governing which substances can be safely recycled. If companies were to factor this in at the outset, there would be more ‘allowable’ material to recycle.

The opportunity

This huge mountain of durable goods, destined to enter future waste streams, represents a valuable ‘urban mine’ of materials that could be transformed safely into raw materials for new products. This requires an efficient collection and recycling infrastructure. While innovators, such as MBA Polymers, have invested in developing the technology to recycle these end-of-life products, there is now a great opportunity to capitalise on the knowledge and experience of ‘first-movers’ like ourselves, and catalyse a sector-wide transition to a circular model.

Plastics recycling industry European ‘wish list’

Procuring and transporting complex mixes of raw materials across borders for the production of secondary raw materials by compliant recyclers within the EU should become more straightforward, more rapid and less costly.

Additionally, it is important to note that there is a complex web of legislation (REACH, ROHS for products, POP, WSR, WFD for waste) to navigate, which can be a barrier to investment and/or scaling up. While the industry can reduce the presence of harmful substances in secondary raw materials as much as possible, it cannot eliminate all substances of concern entirely. Regulators must recognise this when setting new thresholds for raw materials, particularly as there are still at least 15 years of in-use cars still to recycle.

Here are our industry’s key recommendations for change:

- A fast-track notification procedure should be developed to allow compliant recyclers to get better access to complex input materials from other countries within the EU.

- The Circular Economy Package should encourage communication between recyclers and producers by rewarding companies that use traceable post-consumer recycled (PCR) content in their products.

- The EU should set realistic thresholds for substances of concern and invite the recycling industry to be part of the discussion, ahead of any upcoming changes. For example, regulators could exempt PCR materials from certain thresholds within a defined timeframe, or allow plastics containing banned additives to be used in new long-life products.

For the full ‘wish list’, please click here.